RISK MANAGEMENT & INSURANCEManaging risk is the cornerstone of every good financial plan. Covering the ‘what if’s’ with adequate personal insurance helps prevent your plans from unraveling should the unexpected happen. The aim of personal insurance is to give you peace of mind and protect your family’s lifestyle against financial loss.

In formulating your insurance coverage, we take into account your present financial situation, cash-flow, Lifestyle requirements such as education for the children, and we aim to structure the insurance in such a way as to minimise tax and maximise your chance of a successful pay-out. |

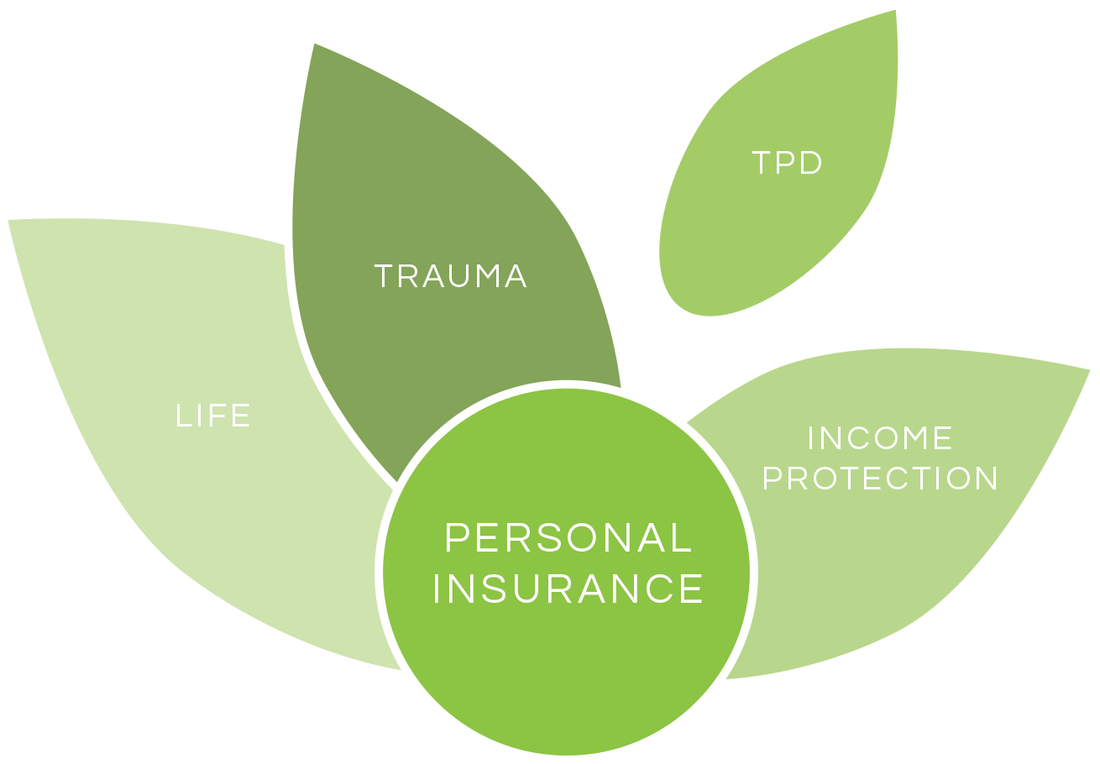

Here are the main types of Personal Insurance we can advise you on:

Life Insurance

Life insurance would pay your family or nominated beneficiaries a lump sum should you pass away or become terminally ill.

Total and Permanent Disability (TDP)

Would pay you a lump sum should you be unable to work again due to total and permanent disability.

Trauma Protection

Would pay you a lump sum should you be diagnosed with a major illness such as cancer, stroke or heart attack.

Trauma Insurance for Children

Would pay a lump sum should your child pass away or be diagnosed with a major illness such as cancer.

Income Protection

Would pay an ongoing income (income stream) should you be unable to work due to illness or injury.

Life Insurance

Life insurance would pay your family or nominated beneficiaries a lump sum should you pass away or become terminally ill.

Total and Permanent Disability (TDP)

Would pay you a lump sum should you be unable to work again due to total and permanent disability.

Trauma Protection

Would pay you a lump sum should you be diagnosed with a major illness such as cancer, stroke or heart attack.

Trauma Insurance for Children

Would pay a lump sum should your child pass away or be diagnosed with a major illness such as cancer.

Income Protection

Would pay an ongoing income (income stream) should you be unable to work due to illness or injury.